How to secure your future with the right financial planning?

Table of Contents:

What is financial planning?

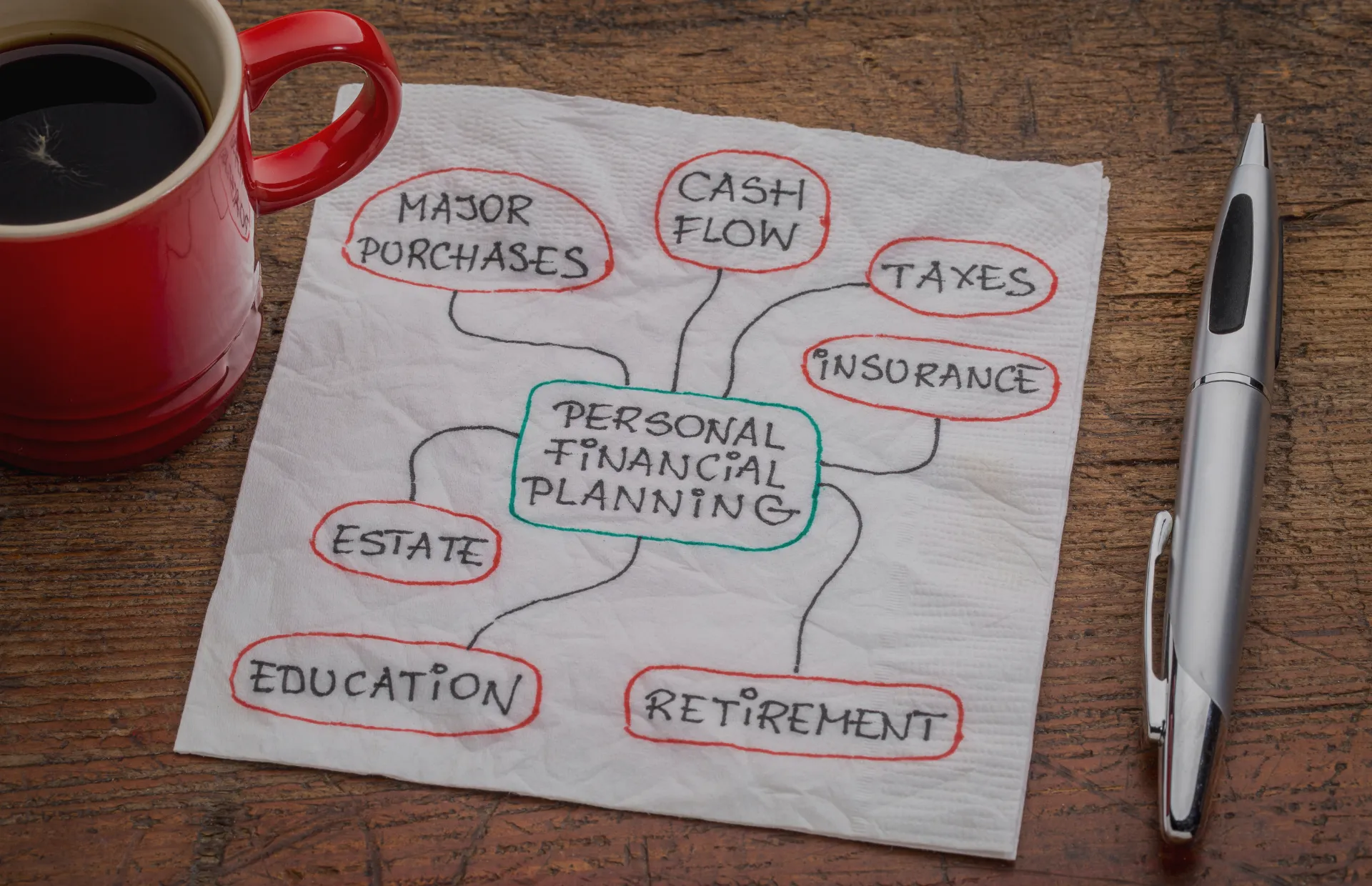

Financial planning is the process of assessing your current financial status including your sources of income, assets, and expenditures, and then making a financial strategy for your future goals. In financial terms, it is the planning in which you assess your cash flows, debts, savings, investments, insurance, and income.

This process is not a one-time process but an ongoing procedure to achieve your future goals by maintaining your current financial position. Financial planning is not rocket science although you might need to be vigilant enough to collect every bit of data related to your expenditures, income, and savings to have an accurate and stress-releasing financial plan.

You can do it yourself or hire a professional financial planner if you are not so good at dealing with complex aspects of long-term planning. Things often seem easier but they might affect you in the future. Let’s see why you need financial planning at all.

Benefits of financial planning?

1. Achieve future goals at the right time

Let’s say you have always wished for a luxury apartment worth 2 million pounds in London and you are saving money gradually to achieve this goal. Now if you are randomly saving the money without knowing how much time it would take to collect 2 million pounds, you might probably end up buying your mansion in the last days of your life. A financial plan can help you in having a realistic goal without burdening yourself. There could also be a chance that you have the potential to save this money in a few years but you are not saving the adequate amount and spending it on extra things. So, with financial planning, you can put the right amount of money in the right box.

2. Financial Truth

We often assume and fantasize that we will get that thing by 2025 or let’s say by 2030 but look back and think about the things that you fantasized about back in 2015 to be achieved by 2022. Some of us might have achieved those things but some of us had to compromise. Why is that so, because we lacked financial planning. Guesswork never works so, it is better to make things solid by having a plan and strategy. That’s not the end, staying stuck to that strategy is what will help you achieve your goals. By having a look at all of your financial aspects, you will be able to envision how to move.

3. No more financial burden on your mind

When you have made some boxes and fixed the finances to be put in them and you stay stuck to it, you do yourself a favor. You better know the financial burden that a person might often feel when the expenditure and income don't complement each other. So, to put them on good terms, make rules for them, and get rid of this mental torture.

Personal financial planning: 5 tips to start with

You might or might not need a financial planner and you can easily assess this by first helping yourself. Here are the 5 financial planning tips for you to make a strategy by yourself.

1. Be clear about your needs

This is an important foundation-making step in your financial plan. When it comes to needing, it must be fulfilled immediately but when it comes to dreams, they are often left on next time. This happens because we start seeing dreams even without looking at our needs. So, first, look at your needs such that what are the things that must be catered to every month. Don’t leave any loophole even for minor things. If going to a doctor every month is your need, it is your need, never forget to count it on the list. Once you will have an idea of every little expense on your need, you will be able to rule out the extras. In case, if nothing lasts in the end, you will realise you need to have another source of income.

2. Start saving right away.

Now when you have identified your needs, and extra expenditures and have another source of income, don’t raise your standards. Keep your cash flow like before and start saving the rest of your amount. No matter if your goal is a long-term goal, you need to start saving from today.

3. Consult with a financial advisor.

Initial consultations are free with financial advisors. It is better to take help from a professional and make a solid plan.

Book your free consultancy now!

4. Create a retirement plan.

So, now you have started saving for your future goals but what will you do when you will be retired and have no permanent job or source of income? It is better to think about it now rather than reach a dead end without a boat. Make a retirement strategy now so that you don’t have to use these savings for your survival after retirement. For a retirement plan, you can consult a professional.

5. Insurance Plan

One of the ways to secure a better life after retirement is to have insurance. It could be an investment that might pay you off in the end. All of these points can help you create a very good and beneficial financial plan but if you don’t find enough time or don’t want to pay attention to it, it is never too late to hire a professional financial advisor.

Who is a financial planner?

A person with a financial background in studies and authentic financial courses or degrees who aims to pursue his/her career in advising people in financial terms is a financial planner/adviser. As per Forbes, there are further subcategories of financial planners but for now, you should simply stick to the basics. You must be thinking that if you can do it yourself then why on earth would you need a financial planner? Well, whether you can do it yourself or not, a financial planner can always be beneficial for you. Let’s see how.

Why do you need a financial planner?

A financial adviser looks into every aspect of your current financial situation and with the help of their experience and insights, they help you in managing your cash flow. They make a financial strategy for you in which every detail of your cash flow is included. They make strategies for you for optimising your budget, debt clearance, expenditures, allocation of your assets for retirement plans, and your goals. They also help you in choosing the right insurance and handling the process for it.

Final thoughts

Now that you know how you can secure your future with the right financial planning and how it works, it is better to start focusing on your financial position to achieve your goals. But if you always find yourself consumed with work, considering a financial planner is a better choice.

Posted On 15 Sep, 2022